Quick Facts:

- ➡️ Russian official Anatoly Aksakov predicts Bitcoin’s collapse due to lack of state backing, though market data contradicts this outlook.

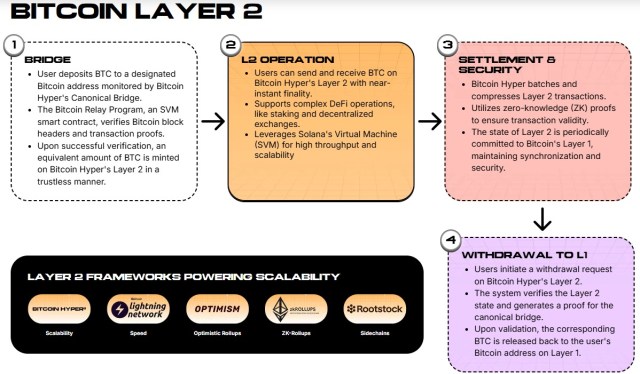

- ➡️ Bitcoin Hyper counters utility concerns by integrating the Solana Virtual Machine (SVM) to bring high-speed smart contracts to Bitcoin.

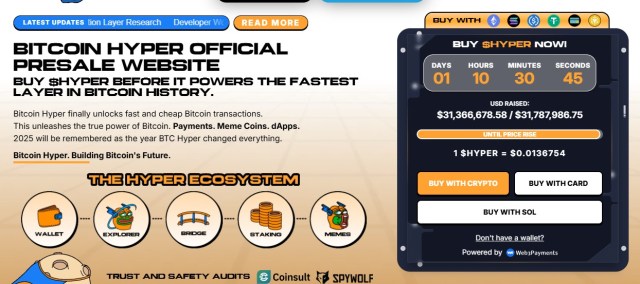

- ➡️ Sophisticated investors have poured over $31.3M into the project’s presale, signaling a shift toward Layer 2 infrastructure.

- ➡️ Whale wallets are actively accumulating, with recent on-chain activity showing seven-figure positioning in the protocol.

Anatoly Aksakov, Chairman of the Russian State Duma Committee on Financial Market, is at it again. He has once again targeted the world’s leading cryptocurrency, asserting that Bitcoin is ‘destined to collapse.’

As a vocal fan of the Digital Ruble, Aksakov argues that without state backing, decentralized assets simply can’t survive the long haul. It’s a bold stance, especially given Russia’s mixed signals, legalizing industrial mining for tax revenue while strictly banning crypto for buying your morning coffee.

Headline-grabbing doom predictions from central bankers are nothing new (sound familiar?), but the market isn’t flinching. Institutional flows into Bitcoin products remain strong, suggesting investors see this as protectionist noise rather than serious analysis. Yet, Aksakov accidentally hits on a real issue: utility.

If Bitcoin wants to be more than just ‘digital gold’ and survive the pressures Aksakov describes, it has to evolve beyond simple storage.

Traders aren’t fleeing; they’re building. We’re seeing a massive capital rotation into high-performance infrastructure layers. Why? Because the base layer is slow and expensive. Liquidity is aggressively hunting for speed and programmability.

That’s where Bitcoin Hyper ($HYPER) enters the picture, a project aiming to bridge Bitcoin’s ironclad security with the execution speed modern finance actually demands.

Learn more about $HYPER here.

The First SVM-Powered Bitcoin Layer 2 Redefines Scalability

The main knock against Bitcoin, that it’s too rigid for mass adoption, is being fixed.

Bitcoin Hyper ($HYPER) addresses this not by altering the base layer, but by expanding it. By integrating the Solana Virtual Machine (SVM) directly as a Bitcoin Layer 2, the network allows for sub-second finality while keeping settlement anchored to Bitcoin’s proof-of-work. In plain English: it’s fast, but it’s still Bitcoin-secure.

This opens up a massive design space for developers. Before now, building complex DeFi or gaming apps on Bitcoin was a nightmare due to Script limitations. With the SVM, Bitcoin Hyper lets devs write in Rust and deploy dApps with Solana-like speeds, thousands of transactions per second, without leaving the Bitcoin ecosystem.

The liquidity implications are huge. A Decentralized Canonical Bridge lets holders actually use their $BTC in high-frequency trading or yield protocols instead of letting it gather dust. This utility effectively counters the ‘collapse’ narrative by turning Bitcoin from a passive rock into a programmable, active capital base.

Get your $HYPER today.

Smart Money Accumulates $31M as Whales Target Infrastructure

While regulators argue over theory, on-chain data shows where the smart money is actually going. The demand for Layer 2 infrastructure isn’t hypothetical.

According to the official presale page, Bitcoin Hyper has already raised $31.3M, signaling strong conviction from early-stage investors betting on the ‘fat protocol’ thesis applied to Bitcoin L2s.

With tokens currently priced at $0.0136754, the project is attracting high-value participants hedging their Bitcoin bets. Smart money is moving.

Etherscan data confirms the trend: two high-net-worth wallets recently scooped up $1M+ worth of tokens, with the largest single buy hitting $500K. This kind of accumulation often happens right before retail catches on, large holders positioning themselves before the wider market grasps the full implications of SVM on Bitcoin.

It’s not just about price appreciation, either. The protocol offers immediate staking after the Token Generation Event (TGE). For yield-focused investors currently priced out of Ethereum’s mainnet (low APYs, high gas), this is a serious draw. By tackling the security-scalability-decentralization trilemma, this Layer 2 is shaping up to be a major liquidity sink for the next cycle.

Buy $HYPER here.

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are volatile and high-risk. Always conduct your own due diligence before investing.